Key Takeaways

- The SEC's climate disclosure rule mandates companies report on climate-related information, including identification, management, and oversight of climate-related risks.

- Companies subject to the SEC's rule will be required to disclose material Scope 1 and Scope 2 emissions.

- Scope 3 reporting was removed from the final rule due to legal complexities and challenges in regulating privately held companies.

The Securities and Exchange Commission (SEC) recently issued a final rule on climate-related reporting. The ruling mandates that registrants must provide comprehensive climate-related disclosures in their annual reports and registration statements for the year ending December 31, 2025.

"This ruling marks a pivotal moment in the evolution of organizational reporting requirements," stated Kristin Gustafson, Director of Sustainability and Energy Incentives.

The proposed rules faced intense public scrutiny over the last two years, with the SEC receiving more than 24,000 comment letters. The regulation will enforce rigorous climate reporting standards for companies, beginning as early as 2025.

Essential Elements of the SEC Climate Disclosure Rule

The SEC’s Climate Rule now requires public corporations to follow a set of guidelines to incorporate climate-related financial information with their SEC filings.

Applicable Parties

The rule applies to public companies reporting to the SEC, including U.S. public companies and Foreign Private Issuers. Company size and filing status play a factor in who is impacted by the SEC Climate Rule. The ruling will be enforced by the SEC.

Implementation Timeline

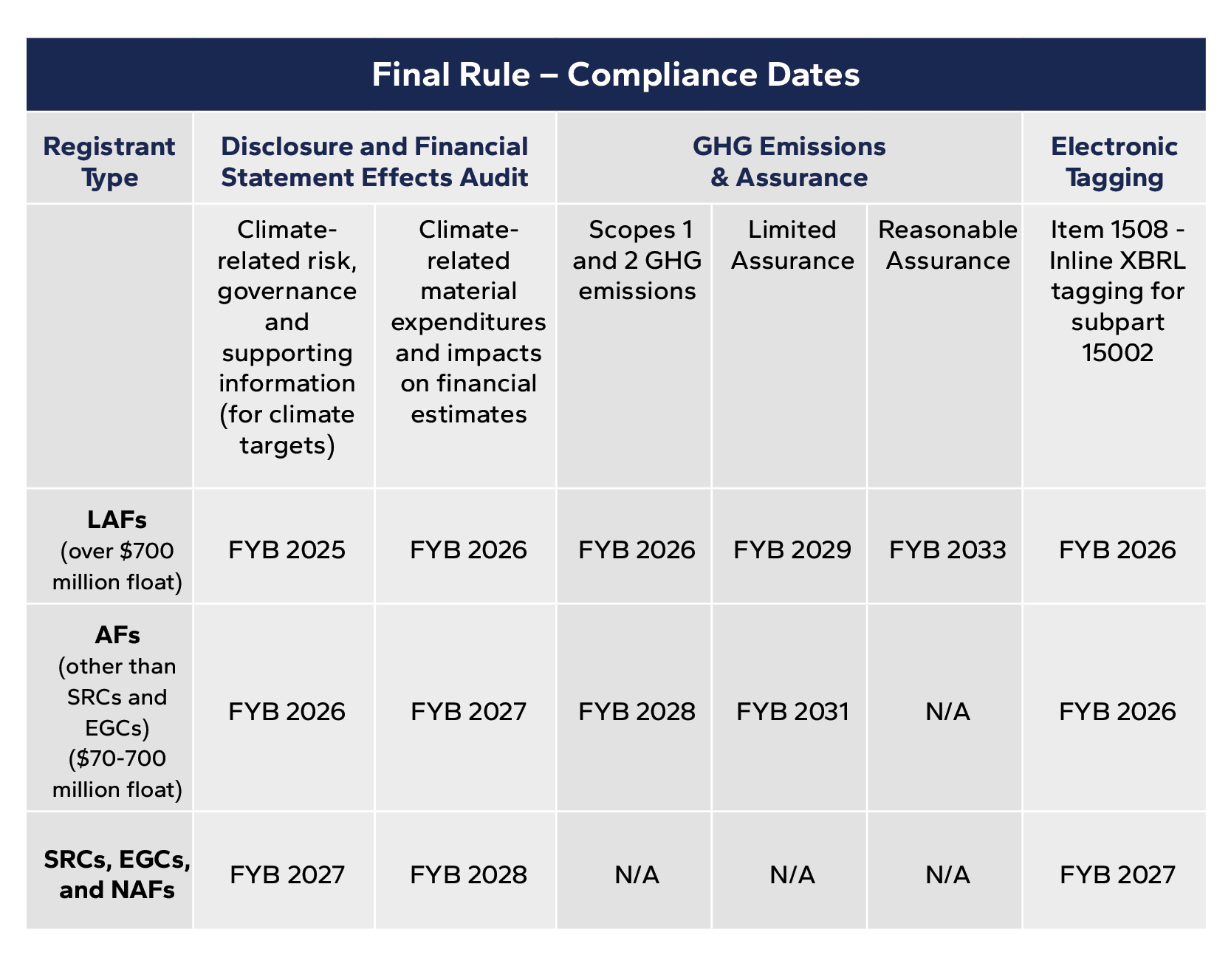

Narrative Task Force on Climate-Related Financial Disclosures (TCFD) based disclosures and financial impact information will be required first. Greenhouse gas (GHG) metrics will be phased in after that.

TCFD-based climate risk disclosure and financial statement effects will be required starting in 2026 for Large Accelerated Filers (LAFs), 2027 for Accelerated Filers (AFs), and 2028 for smaller reporting companies and emerging growth companies. Disclosure of material Scope 1 and Scope 2 emissions will be required beginning in 2027 for LAFs and 2029 for AFs.

Narrative Disclosures

The SEC's climate disclosure rule mandates companies provide a narrative discussion on identifying, managing, and overseeing climate-related risks. This includes disclosure of the company's emissions footprint, aligning with the TCFD framework.

Independently Assured Scope 1 and Scope 2 Emissions

Companies subject to the SEC's rule will be required to disclose material Scope 1 and Scope 2 emissions. These disclosures will need to be independently reviewed. This requirement applies to Accelerated and Large Accelerated Filers, with a phased implementation over time.

Financial Statements

The SEC rule necessitates companies include a note in their financial statements detailing the quantitative financial impacts of severe weather events on their operations. This includes:

- Capitalized costs.

- Expenditures.

- Losses from severe weather events such as fires, sea-level rise, and flooding.

The provision applies to financial impacts that are at least 1% of a line item.

Timing for Roll-out of the SEC Climate Rule

What You Need to Know

- Larger publicly traded companies will be required to report Scope 1 and Scope 2 emissions.

Scope 1 covers a company's direct GHG emissions, while Scope 2 includes GHG emissions from the energy providers used by the company. This reporting will be mandatory when companies determine GHG emissions are material to their shareholders.

- Scope 3 reporting was removed from the final rule due to legal complexities and challenges in regulating privately held companies.

Scope 3 would have required companies to gather information from privately held firms, extending beyond the SEC's regulatory authority.

- The U.S. will maintain its current materiality standard, which focuses on financial materiality rather than the double materiality standard used in some other jurisdictions.

The double materiality standard considers both financial impacts and broader environmental, social, and governance factors that could influence shareholder decisions.

- Companies will be required to file disclosures directly with the SEC, rather than just posting them on their websites.

Accelerated Filers and Large Accelerated Filers will also need to include attestation reports with their filings, due along with their regular second quarter report.

- The rule reduces the footnote requirements, shifting them from Regulation S-X to Regulation S-K.

While Regulation S-K disclosures are not subject to audit, they must meet reporting standards. The footnote requirement previously called for companies to amend previous years' disclosures to account for costs, expenditures, and charges related to severe weather events.

Next Steps with the SEC Climate Rule Changes

The SEC climate rule represents a substantial shift in how businesses now report climate-related data.

To prepare for the new SEC climate reporting mandate, companies should:

- Understand the requirements. Prepare for the Climate Rule by learning about the reporting obligations for your specific business size.

- Evaluate current reporting. Look into your existing climate disclosure with the new rule’s requirements. This will help identify areas where processes and systems are needed.

- Conduct risk analysis and materiality assessments. You should consider an evaluation of potential climate-related risks that may need reporting. You could also consider a financial materiality assessment to ensure all climate risk data is captured.

- Review your systems. Ensure your systems are able to collect GHG emissions data and other climate-related disclosures.

- Build a relationship with a trusted advisor. LAFs and AFs should work with a business advisor to ensure compliance with the SEC’s attestation requirements and validate emissions data.

Our team of advisors is ready to help your organization navigate the new SEC requirements.

Make a habit of sustained success.

Energy Services

The right information, planning, and resources will set you up to become an agile leader in the energy industry.

Who We Are

Eide Bailly is a CPA firm bringing practical expertise in tax, audit, and advisory to help you perform, protect, and prosper with confidence.